In this video I am going to teach you how to use the Iron Condor option trading strategies that can be used in almost any market.

Far too often investors just pour their money into the market and hope it goes up. And that’s often okay and wise for many people that may be investing a certain amount of money monthly and putting it into a retirement or other investment account.

However, options can give us more options and allow us to grow our money in an actively traded account much faster than the S&P 500.

I’m going to show you:

- One of my favorite and option strategies that can be used in almost any market

- How To Place An Iron Condor Option Trade (Showing a real example on the option trading platform)

——————————————————————–

Hey guys, Darren here. Wow, do we have a video for you here today. But before we get started, I want you to close the the other windows you have open because this will be some good stuff that will allow you to make a lot of money.

Alright, I want you to take a close look at a strategy that not only limits your risk, but this strategy also allows you to make money when the stock price moves in different directions. Up, Down Sideways

I promise that we will dig into many different detailed option trading tips and tricks, and dive much deeper into options in future videos. So please do subscribe if you haven’t already.

For me it’s super important that I am using strategies that allow us to trade options and make money when a stock moves in different directions.

————————————————————

First, Be sure to download the FREE options Workshop in the link below.

It talks about the two main benefits of trading options over buying stocks.

DISCLAIMER, I am not a financial planner and I am not recommending trades. Please do your own research and if you are new or learning options, I recommend you start small.

—————————————-

What is one of my favorite option strategies that can be used to make a lot of money?

Guys, we are talking about the Iron Condor option strategy.

What is an Iron Condor?

It’s a big super hero bird that flies down from the sky and rescues people that are in trouble.

Noooo….

So let’s start with a definition.

An Iron Condor is an option trading strategy utilizing two vertical spreads – a put spread and a call spread with the same expiration and four different strikes

You guys are excited now right? (Crickets)

Options are used by big institutions, billionaire investors and hedge funds.

I think it’s important that we understand all the different strategies and ways that the rich are getting richer. So that we can have the tools to do the same and do better for ourselves but while doing it safely.

Many people buy options, but as you know from previous videos buying options is a low probability trade. It is much easier to profit by consistently selling options. And sometimes I like to be able to profit when t0he stock stays within a range since we don’t always know if the stock price is going to move up or down for sure.

So if we pick a strike above the current stock price and also pick one below the current price and the stock stays within that range by the expiration date, then we win and keep all of the premium we collected when we place the trade. An Iron Condor is that simple.

We want to be able to do it in any market and have different tools, an arsenal, a bag of tricks and strategies for different situations.

Now be sure and watch until the end, because after you learn how to put on this trade and use this simple strategy I’ll have a special bonus for you that you can use going forward that a lot of people don’t think about and it will increase your profits!

So if you are ready….go ahead and hit that like button and lets begin!

How Do We Sell An Iron Condor?

Alright for today’s strategy, we are going to take a look at how to sell an Iron Condor and be able to profit whether the stock price stays where it is or moves up or down.

What is great about this strategy is that it utilizes less money and therefore it can be less risky (it’s actually defined risk so you know the max loss upfront).

Now don’t worry we are going to go through everything in detail.

So you might be asking yourself. What exactly are those two Vertical Spreads that make up the Iron Condor and how do you place the trade?

Well let’s look at the first half of the trade or one wing. The Put Vertical Spread.

Go to your Tastytrade account or whichever platform you are using. By the way, Tastytrade is one of the best and most intuitive for trading options. I’ll put a link down below. Right now you can get up to $3000 when you fund an account.

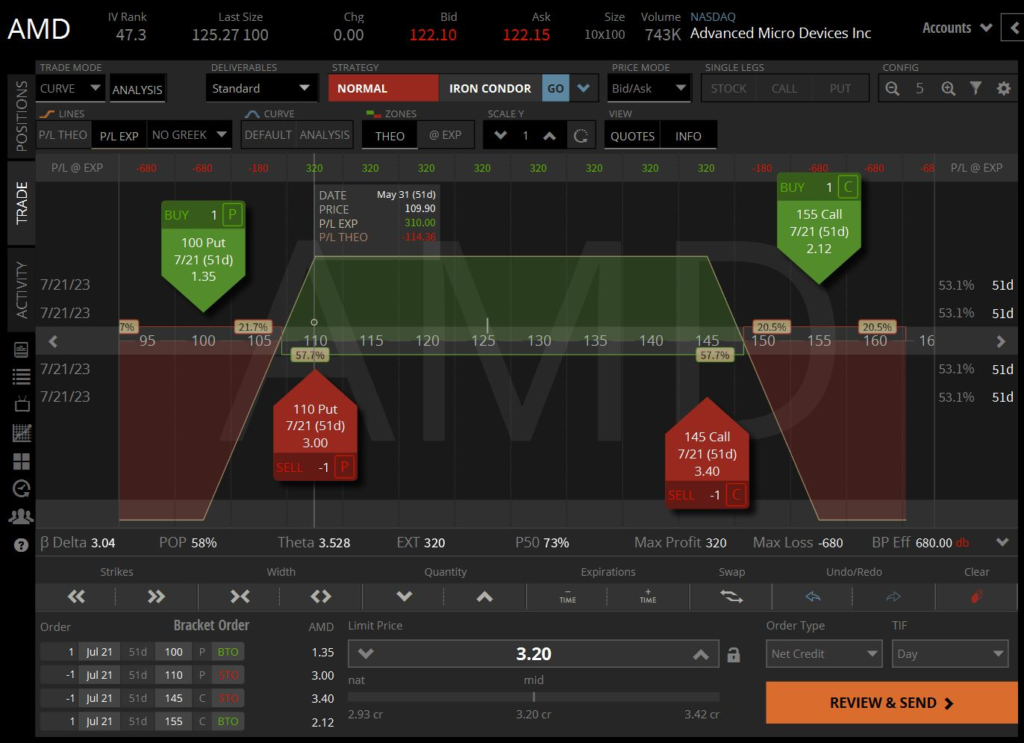

Open up your app and let’s go to a company we all know and love by punching in AMD on the trade tab.

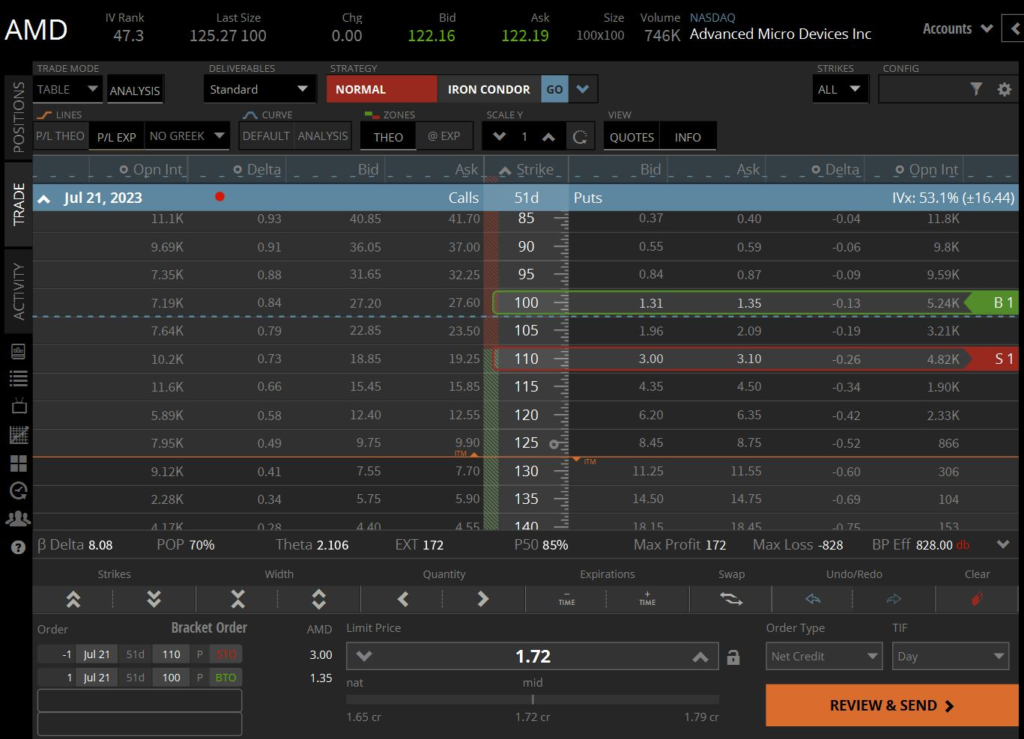

We look at the option chains and click on the July 2023 chain since it is closest to 45 Days To Expiration. 45 days is the sweet spot since it allows you to collect a good amount of premium in a fairly short period of time while still allowing enough time to be right.

Let’s start by selling the Put Vertical first. We want to go to around the 25 or 30 delta. Delta is the column 2nd from the right and measures how far out of the money we are. So it’s basically a hedge ratio. You can see if we go further down to the 6 delta we would only collect 55 cents or dollars since one option contract controls 100 shares of stock. So it has a much less chance of finishing in the money at the end of the 51 Days to expiration. In fact it would have a 1-6 delta or a 94% chance of still being OTM out of the money at expiration. The higher the probability of profit the lesser amount of premium you collect. More risk and more premium. You get it.

So we click on the bid to sell the 110 strike and ask to buy the 100 strike for downside protection. This makes this Vertical spread $10 wide and the 100 put serves as the protection since we would be buying back the option if it dropped below that level.

If the stock price did drop below the 100 level, the max loss would be the 110 – 100 = $10 width – $1.72 in premium collected. Or $826. The Tastytrade platform also shows you this right on the platform in the lower right.

This is the first vertical spread that we are selling. It is a credit spread so we collect $1.72. 1 option contract controls 100 shares so that equates to collecting $172 upon placing the Put Vertical Spread.

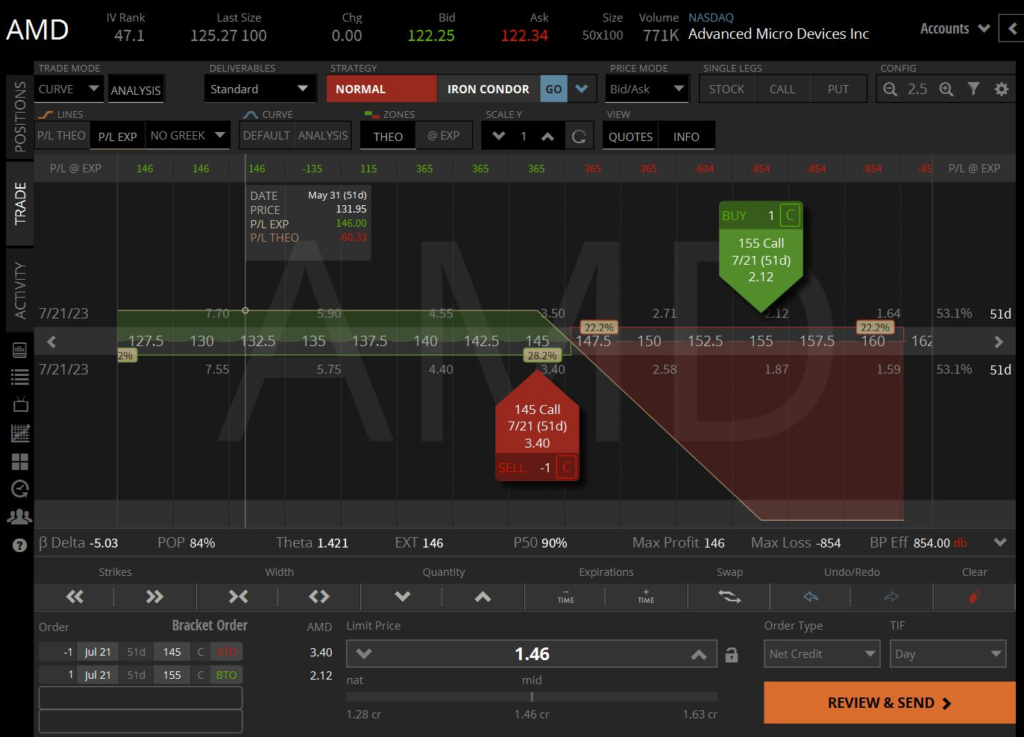

By clicking on Curve Mode we can see that we collect max profit as long as the stock price stays above 110. The 100 Put option that we bought serves as protection and caps the max loss should the stock price drop down significantly. You can see where the curve flattens off and is capped all the way down to zero.

I don’t think AMD is going to go bankrupt any time soon. But hey, you’re protected if it does.

The breakeven on this Vertical spread is the 110 short strike – $1.72 premium collected = $108.28. Since it is currently at $125.27 it would take a 13% down move before we lost a penny.

So that is the first half of the Iron Condor. Now we will do the same thing on the up side or Call side of the Iron Condor.

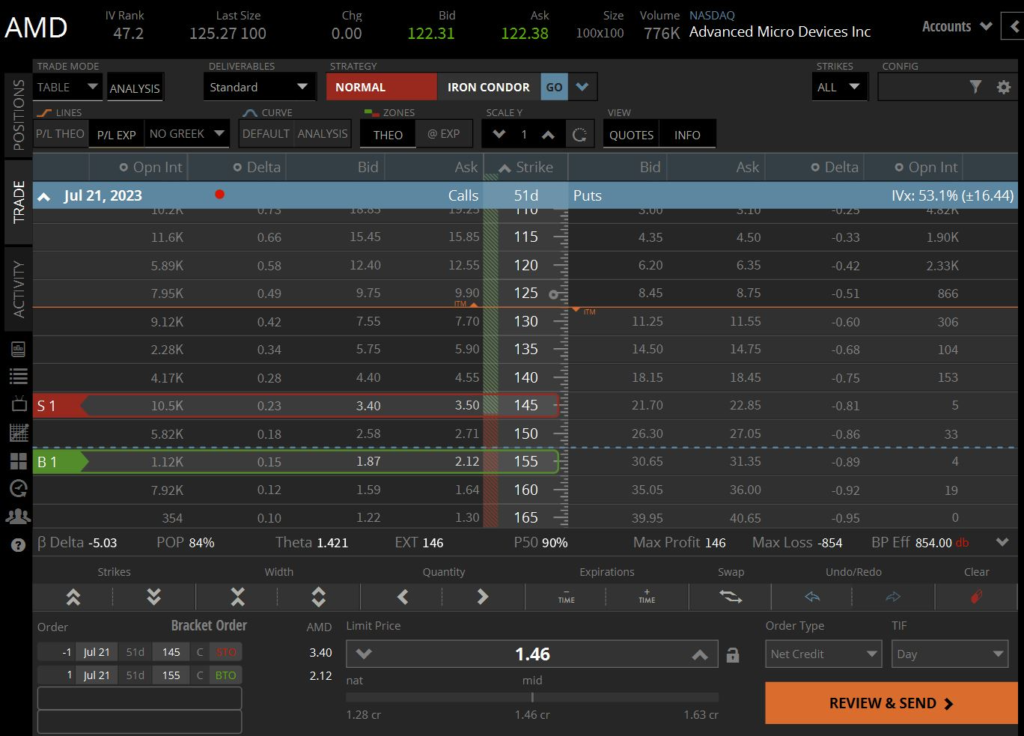

We click on the Bid to sell the 145 Strike and the Ask to buy the 155 Call strike. We collect $145 for this side of the trade.

By clicking on Curve Mode we can see that we collect max profit as long as the stock price stays below the 145 strike price. The 155 Call option that we bought serves as protection and caps the max loss should the stock price shoot up.

The breakeven on this Call Vertical spread is the 145 short strike + $1.46 premium collected = $146.46. Since it is currently at $125.27 it would take a 14% up move before we lose a penny.

This is the second half of the Iron Condor.

Now we just demonstrated how to sell a Put Credit Spread and a Call Credit Spread in two separate trades.

Wouldn’t it be nice if we could place one trade incorporating both verticals?

Guess what? We can!

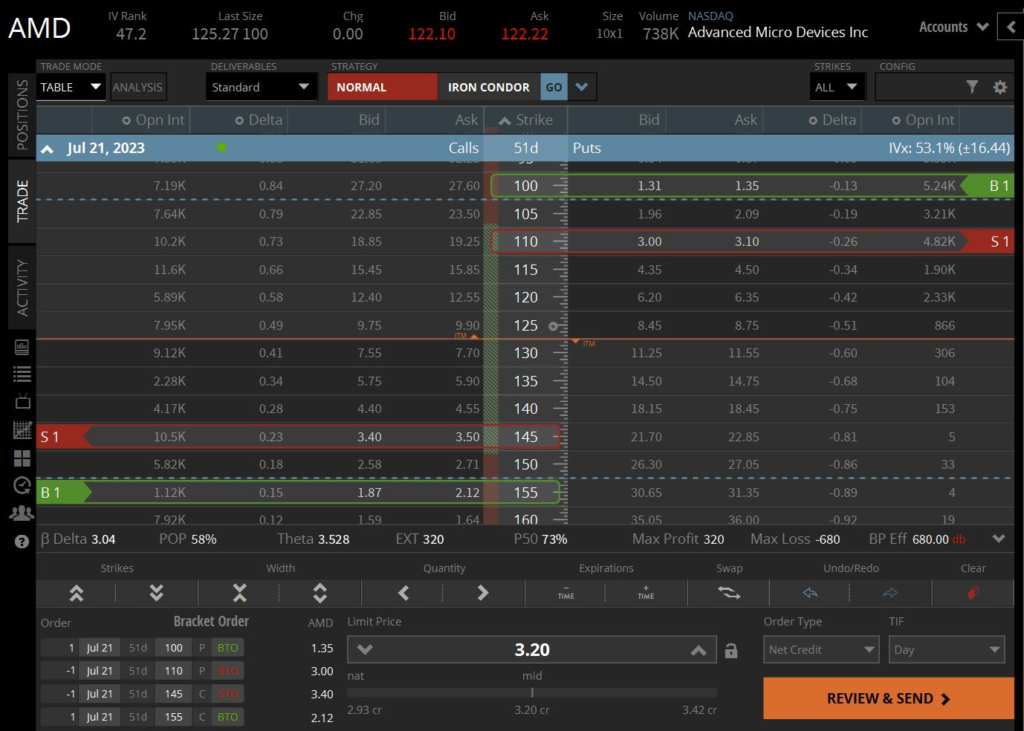

So we place the same verticals by doing exactly what we just did in placing the vertical spreads. We just do it all at one time.

So we click on the bids to sell and ask to buy the protections.

Switching to Curve mode we see the same profit zones on the downside and upside. With the stock price currently at $125.27 we have the same 13% downside breakeven and 14% flexibility to the upside.

So that is a whopping 27% range that the stock can move around where it is today within the 51 DTE Days to Expiration, we still remain profitable.

The best thing is that when both Vertical Spreads are sold (not bought) the Iron Condor trade will net you a credit.

So in this case when all the trades are put on we collect $320 for placing this trade. This is because we are collecting premiums on both sides!

The other best thing is even if we lose on one side we have max profit on the other side. So we win on one side no matter what!

We ultimately hope that the stock price settles within the range between the short strikes. Then we win on both sides and keep the entire credit collected upfront when we place the trade.

When placing an Iron Condor, we want to shoot for collecting about ⅓ the width of the strikes. So in this case the width of our strikes is $10. The 155 Long (long being the Call Strike we are buying) is $10 away from the $145 Short Call strike. Short meaning we are selling it.

⅓ would be $3.33 or $333. We are collecting $320. So it’s really close. You can move our verticals in closer and collect more in premium or out further and collect less.

Now we mentioned that bonus…here it is….

Not every trade is going to go our way….

There is one thing that we can do if the stock price moves against us.

Would you like to collect more premium?

Ok then….

We can manage our Iron Condor trade. So let’s look at:

What are the possible outcomes of an Iron Condor option trade?

Now there are two things that can happen with the stock price.

The stock can stay between our 110 Short Put strike and $145 Short Call Strikes. In this case, it’s easy. We keep all of our $320 in premium that we collected when we placed the trade.

Now the second thing that can happen is that the stock price can drop below our 110 short strike price. It can also rocket up past our 145 Short Call option and be in the money.

It’s nice to know when this does happen, is that we have on the long legs that we bought for protection. This limits our losses.

Whew! (wipe forehead)

When the short strike is breached I close out and roll the winning side of the trade. We roll it up closer to the losing side and collect more option premium.

Say the stock price shot up past the 145 short Call strike. What we can do is roll the 100-110 vertical and up to say the 125-135 strikes. By doing this we can collect more premium and move our max profit zone up. Sometimes another $100 or even $200.

So we are actually moving with the trade. I love sports, and I like to think of it as someone guarding me in the post playing basketball. There on my left and overplaying me. So I roll right and slam dunk!

No….

Depending on how far in the money the stock price goes, we can roll all the way up to the short strike of the winning side to collect additional premium. That would make it an iron fly, not an iron condor.

We still want to keep our $10 width and we don’t want to go past the short strike. That would increase our risk and open us up to possibly being whipsawed if the stock moved up and then came back.

Which it will do. I know…….

Alright guys, if you are a beginner and this sounded confusing do not worry. It did for me as well originally. We will be continuing to cover the details in future videos and we’ll continue to learn and succeed together.

———————————————————————————–

I’ve put a link down below for the FREE Options Workshop. Be sure to grab that.

Remember to hit like and subscribe and leave a comment below with your thoughts on the video. Let me know, what you are trading and what you would like to see in upcoming videos.

Thanks for watching. Please share this video with a friend and see you in the next one!