Many investors are looking for the best weed stocks to buy in 2022. The reason for this is that the legal marijuana industry is expected to grow exponentially in the next few years.

According to a report by Grand View Research, the legal marijuana market is projected to reach $73.6 billion by 2027. This growth is being driven by the increasing legalization of marijuana around the world, as well as the growing acceptance of cannabis as a treatment for various medical conditions.

Investors are looking to get in on the action now so that they can reap the rewards when the industry takes off. However, with so many options available, it can be tough to know where to start.

In this article, we are going to answer the questions:

Why has the cannabis sector been hit so hard over the last year?

Is the cannabis industry expected to grow over the next year?

What is the best marijuana stock to buy in 2022?

So let’s first look at the question:

Why has the cannabis sector dropped over the last year?

The cannabis sector has been hit hard over the last year for a few reasons. Firstly, the industry was very hyped up in 2019 and 2020 as legalization swept across North America. This led to a lot of investors buying into the sector without really knowing what they were doing.

As a result, when the reality of the industry set in (that it is still very much in its infancy and has a long way to go before it reaches its potential), many investors bailed out, leading to a sharp decline in the sector.

Another reason the cannabis sector was hit is that many companies are still struggling to turn a profit. This has raised concerns that the sector may not be as profitable as originally thought.

Is the cannabis industry expected to grow over the next year?

There is little doubt that the cannabis industry is expected to continue growing over the next year. The legalization of marijuana in a growing number of US states will continue to fuel growth in the industry. States require money to fund their programs and the tax dollars generated from legal cannabis sales will help to do this.

The increasing acceptance of cannabis as a treatment for various medical conditions will also continue to drive growth. More and more people are turning to cannabis as an alternative to traditional medications.

Currently, about 20 states have fully legalized both medical and recreational marijuana use. There is strong public favorability for marijuana legalization.

However, at the federal level, it is still illegal. This creates a lot of problems for the industry, including difficulty in accessing banking services, high taxes, and strict regulations.

The profitability of the cannabis industry is still a concern. However, many companies are scaling up their businesses and turning a profit. With increased revenues, companies can invest in much-needed infrastructure, research and development, and marketing to expand their growth. This is key since it has proven difficult for many to obtain financing from traditional banks due to the federal stance of it being illegal.

What are the best marijuana stocks to own in 2022?

There are a variety of cannabis stocks to buy right now and they are so super inexpensive.

Since interest rates are on the rise and it will be more expensive to borrow money in the future, many investors are turning to low-priced stocks that they can buy now and hold for the long term.

Some of the industry’s top picks include Aurora Cannabis, Canopy Growth, Cronos Group, and Tilray. All of these companies have strong growth potential and already established a solid presence in the industry.

However, one of the best in today’s market might be Innovative Industrial Properties (IIPR).

This company is a REIT and owns and leases out cannabis cultivation and processing facilities to growers across the United States.

This article from Simply Wall Street talks about the stock being down recently but up 891% over the last 5 years!

Innovative Industrial Properties share price has gained 72% in three years and EPS is up 75% per year over that same period

Kody Kester wrote an article for The Motley Fool discussing 3 reasons why the stock is inflation resistant. The business model stability and visibility, tons of growth for the industry ahead and a cheap valuation.

These are all great points and the first one (Strong Business Model) outlines why Industrial Properties is one of if not the best in the sector. The REIT acquires freestanding industrial and retail properties from state-licensed cannabis operators. Industrial Properties then leases back to those same operators.

The companies love this since they can use the capital gained from the real estate sale and then invest it back into the business to fuel growth. They do long-term 15-20 year leases which provides visibility for Innovative Industrial Properties.

Innovative is well diversified with $2.1B worth of real estate. This encompasses about108 different properties. So if any one property runs into trouble it really won’t affect the overall portfolio.

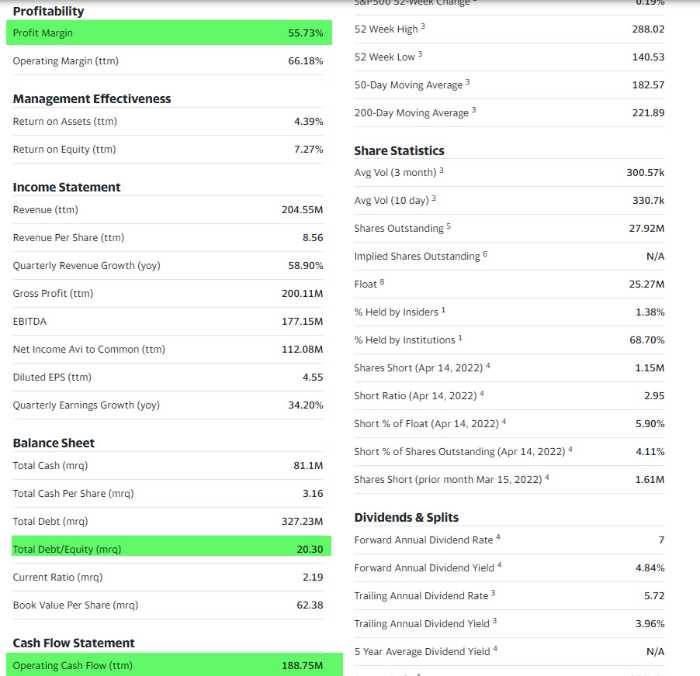

Innovative Industrial Properties has strong financials

With the $2.1B in assets and just $327M in debt. The Debt to Equity ratio is just 20 and the operating cash flow is $188M. They have a tremendous 55% profit margin which is exciting and tells you it is a great business!

Conclusion

Analysts anticipate that 100% of U.S. states will legalize medical marijuana by 2025, and nearly 50% of U.S. states will legalize recreational marijuana use by that time. The U.S. regulated cannabis industry is expected to nearly triple from $18 billion in 2020 to $47 billion by 2026.

Over the last couple of years the cannabis industry has been hit hard. So there are some great values in weed stocks. Investors looking for one of the best weed stocks in 2022 may should consider Innovative Industrial Properties. With strong business fundamentals, diversified real estate holdings, and cheap valuation, this company offers a great opportunity for investors to get in on the ground floor of the booming cannabis industry.

If you like the sector and don’t want to bet on one stock then an ETF is the way to go. YOLO, MJ, and MSOS are the best marijuana ETFs. Innovative Industrial Properties is held in all 3 of them.

Always do your research and consider your investment goals before you begin trading stock options. For more stock and financial information, please check out our other resources at OptionsFinanceProfits.com.

What are your thoughts on cannabis stocks? At what point do you think they will recover and shoot higher? Leave your comment below!