Will there be a stock market correction (or possibly a crash) coming in 2022?

Financial success in life is obtained by learning and taking control of our own finances. We look at the current market environment taking advantage of opportunities that are available right now.

So, if you are interested in stocks, options, finance, and profits and want to grow your portfolio much faster than the S&P, please be sure to finish reading this article.

Lastly, full disclosure, We are not financial planners and are not making trade recommendations. We are just letting you know what we are doing at this time. Please do your own research and decide on your own what is best for you.

Alright, do we think there is going to be a stock market correction or possibly a crash coming in 2022?

Yes! A correction (which is defined as greater than a 10% decline) for 3 main reasons!

The first reason is rising inflation and Fed tightening.

https://www.foxbusiness.com/economy/federal-reserve-taper-bond-purchases-december-2021

In this article from Fox Business, it talks about how the Fed Chair Jerome Powell is eyeing 3 interest rate hikes in 2022 to combat inflation. Powell said he would double the reduction of its asset purchase program to $30B dollars a month.

This was all in response to the inflation numbers that came out. The cpi consumer price index numbers rose 6.8% in November from a year earlier. It was the fastest pace since 1982.

Powell said that he had originally expected the pandemic induced supply chain issues to fade this early this year allowing retailers to meet demand. But he conceded that inflation has been higher and longer lasting than initially anticipated.

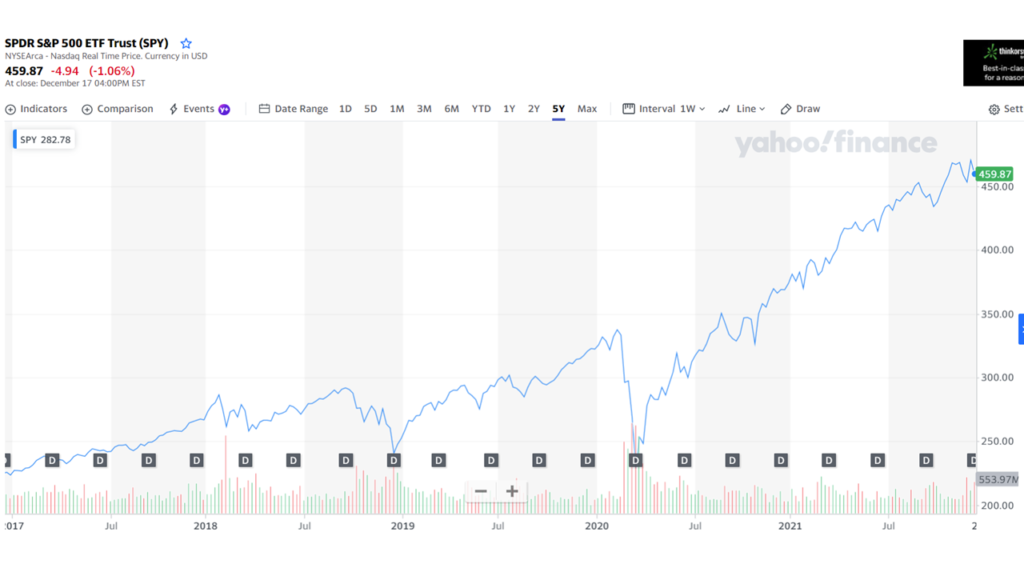

The second reason why we believe there will be a stock market correction at some point in 2022. Stocks are at All Time Highs!

Take a look at the chart of SPY which is the ETF that tracks the S&P 500. We are at all time highs!

Lastly, the third reason why we believe there will be at least a stock market correction at some point in 2022.

History tells us there will be.

In this article by Ben Carlson, he talks about the S&P being up 80% since March 2020.

There have been 36 double digit drawdowns (10% is a correction). That is one every other year on average.

So we are due!

Alright, so we see that interest rates are set to rise in 2022 and we know stock prices are again at all time highs.

So, what are we doing now with the market still at highs?

Are we going to sell all of our high growth tech high flyers?

No!

We still want to hold them, but not necessarily add to them. As high growth tech stocks will continue to fuel the economy like they always have.

Nobody wants to see a stock market crash or people get hurt. However, a 10-15% decline or correction is healthy for the market. We can then start moving in and buying a little.

If and when there is panic selling and everyone thinks the economy and world is coming to an end, that’s the time we want to load up and buy more up to our max allocation.

If we are currently under allocated or want to rotate underlyings out of growth stocks, we need to pick the right stocks that do well in this environment.

So, here is the list of our Top 3 Stocks To Own In A Rising Inflation And Interest Rate Market.

WFC Wells Fargo

In this article, Bram Berkowits from the Motley Fool, tells us why shares fell. It was basically for no obvious reason. Just a broader bank stock industry down move.

Banks make money by borrowing money short term and lending it out on a longer-term basis.

When interest rates rise like they are doing now and will continue to do, bank margins increase and banks do well. Its as simple as that and why we are investing in Wells Fargo right now.

LMT Lockheed Martin

Lockheed Martin is one of the largest Defense Contractors in the world.

In this article Brett Schafer talks about their Aeronautics business alone. Lockheed’s most recent contract with Finland for its F-35 fighter is for 64 jets. It will last 20 years, and then maintenance work will last into the 2070s.

Lockheed’s Space segment has the potential to grow its revenue for a long time as the U.S. government builds out the Space Force. The segment is already projected to do $11.85 billion in sales this year.

Lockheed also has a current dividend yield of 3.2%.

Okay, I may get some flack on my last pick, so feel free to let me know if you agree or disagree in the comments.

COST Costco

Our last pick is Costco. Costco is a retail growth stock that is normally not thought of as an inflation hedge. However, they are also selling groceries and household items that people need and buy every day. They are also selling gas and they have a membership based business.

So they are not merely just a retail growth stock.

Sales is growing as well as their number of subscribers.

Customers count on receiving the best possible price on most products. This allows them to shop freely without worrying about whether they’re getting enough value.

Alright, we’ve got a bank, a defense stock and a retail so we also diversified with these 3 rising inflation and interest rate stock picks.

This covers why we think there is going to be a correction coming in 2022.

All three of these stocks pay a dividend. Another reason to own these stocks now and really at any time.

We also discussed our Top 3 stocks to own in a rising inflation market.

Now I need your help!

If you liked this article, please share it with your friends. Also, leave a comment and let me know what you are buying.

We will also be writing an article that covers the Top 3 stocks that we will want to buy after a correction. Be sure and keep an eye out for that article.

Thanks for reading and make it a great day!

Darren Steves