Today we are going to discuss our favorite high value option strategy and why now is the perfect time to use it to place a trade in (JWN) Nordstrom.

We are going to take a look at why this strategy is one of the best to use to take advantage of current high value opportunities available in the market right now. We will also show you exactly how to put on the specific trade in Nordstrom (JWN) on the tastytrade platform. As well as how to manage and exit the trade.

Alright, what is a high value opportunity?

A high value we don’t just mean high potential dollar win amount. We are talking about opportunities that not only have high potential dollar win amounts but they also have low risk. So in other words we put up a little amount of money in order to potentially make a lot of money.

So what is our favorite high value option strategy right now and why?

Our favorite high value option strategy right now is buying a deep in the money long call option.

There are a couple of reasons why this is our favorite high value options strategy.

The number one reason being that we can make a lot of money through price appreciation.

The trade has a high dollar uncapped potential gain to the upside.

The second reason this is our favorite high value option strategy is that it is safe and reduces risk.

The Max loss is the debit paid upfront so you can’t lose more than that no matter where the stock goes.

If the stock moves up the value of our option increases and we can also sell a call to lock in profits.

We will walk through the JWN Nordstrom trade and demonstrate all of these benefits.

However, let’s first look at why we are choosing to go long in JWN Nordstrom.

The first reason is because, I just like the Nordstrom store.

I like the atmosphere in the store but most of all I like the quality of the clothing. I also really like the way the clothing fits. It’s also a stock that has been beaten down, mainly due to Covid. Nordstrom also has good fundamentals.

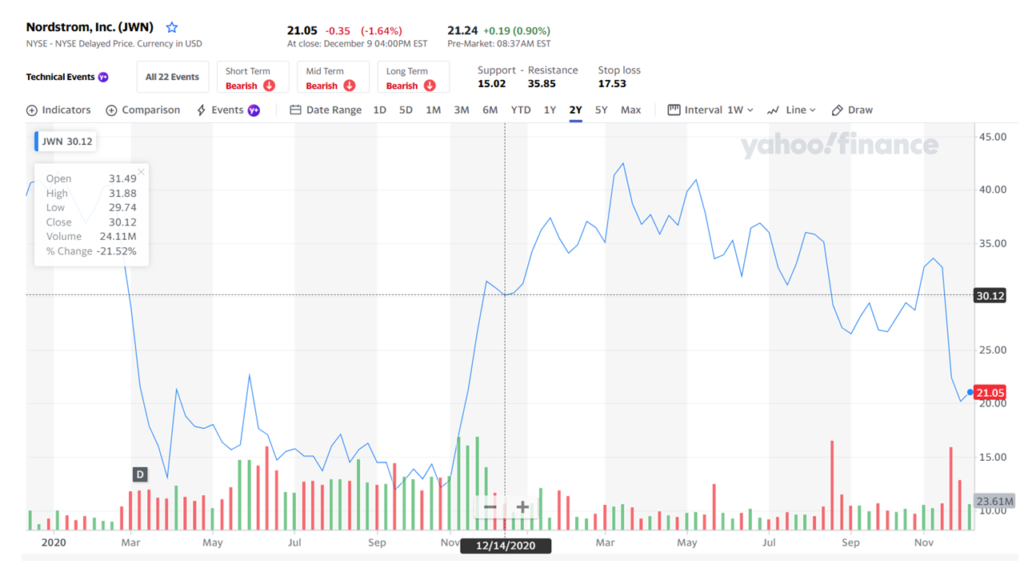

As you can see from the chart below the stock has been pretty well beaten down.

We think the risk of Nordstrom continuing to go too much lower is minimal.

It is a brick and mortar retail store that will come back and has a great online business. It should do very well as Covid gets behind us. More people will continue to go back out into the stores to shop.

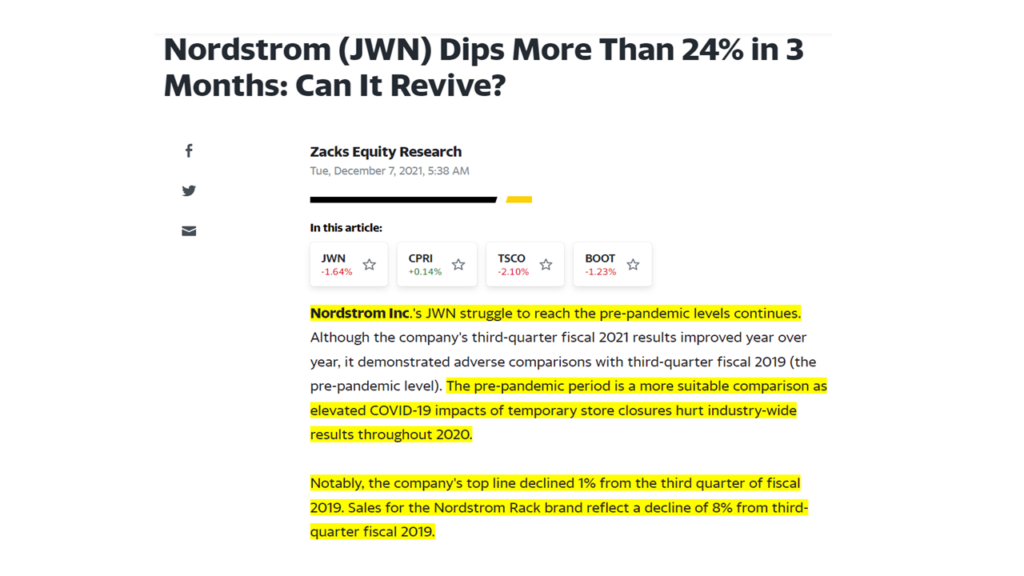

In this article from Zack’s Equity Research they talk about Nordstrom’s 24% decline in the past 3 months. It discusses their struggle to get back to the pre-pandemic levels and how store closures really hurt industry.

https://finance.yahoo.com/news/nordstrom-jwn-dips-more-24-133801907.html

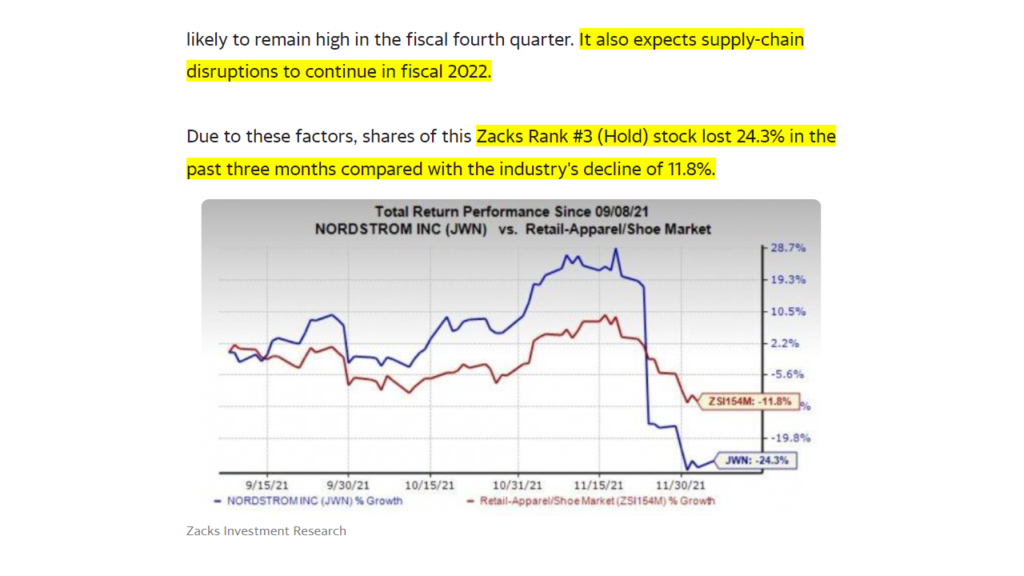

Nordstrom expects the supply chain disruptions to continue in the near term. As you can see from this chart the rest of the industry declined only 11.8% versus Nordstrom’s 24% .

There is some good news in that the digital business did very well at both Nordstrom and the Rack.

Total revenue and net sales both jumped about 18% year over year. Management expects revenue growth of 35% in fiscal 2021.

These are all the reasons we are bullish in Nordstrom and think it will head quite a bit higher over the next 12 months.

Let’s utilize our favorite deep in the money long call option strategy to place a trade in JWN Nordstrom.

As always, we are using the tastyworks platform. Please use the link below to open a tastyworks account if you don’t already have one and you can receive $500 from tastyworks. We think its the best brokerage for doing what we do.

https://start.tastyworks.com/#/login?referralCode=MB9KEHV4RK

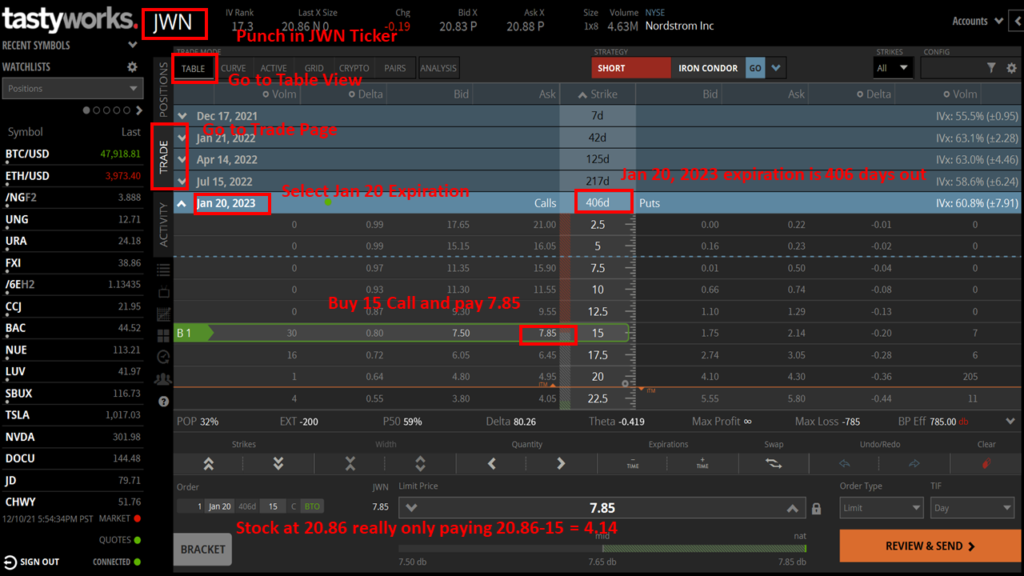

Log onto the platform, punch in the ticker JWN and go to the trade page.

We first click on the Table View. Then click on the Buy and pay 7.85 ($785) for the Jan 15, 2023 15 strike 406 days out. So it is over a year out. We are going over a year out because it gives us much more time to be right. There is really no downside to going that far out. When the price moves up (or down) the corresponding price of the option will move in conjunction with it.

When we pick the 15 strike, we pay $7.85 or $785. So with the stock currently at $20.86 we are really only paying 20.86 – 15 = 4.14 or $414.

Let’s say the price of the stock moves up to $30. We then make the difference between the 15 strike and 30 or $15. The 15 actually equates to $1500. The beauty of using this strategy is that we can close the trade out at any time. We do this by selling the option back for the $1500 profit. We don’t have to wait until expiration. So if the stock goes up quickly we can make money quickly.

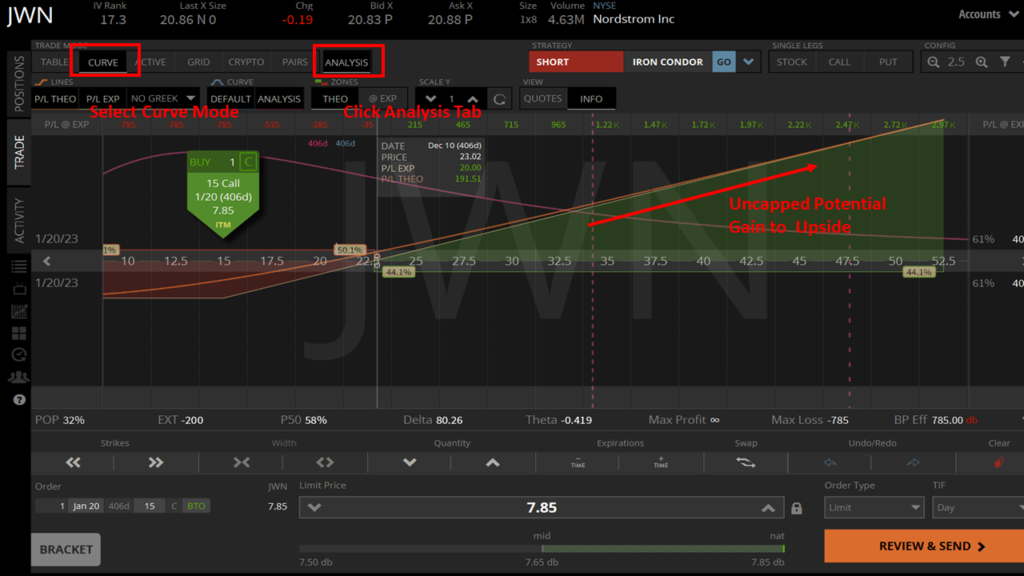

We click on the Curve Mode and also click on the Analysis tab. We then can see that our profits increase as the stock price moves up.

This is the #1 reason for using this high value option strategy. The trade has a high dollar uncapped potential gain to the upside.

The second reason this is our favorite high value option strategy is that it is safe and reduces risk.

The Max loss that we can have is the $785 debit paid upfront. We can’t lose more than that no matter where the stock goes. This really limits our risk because even if the stock goes down. It will most likely never be worthless unless the company goes out of business. We will likely never hold onto this option until expiration.

Now we will cover how we will manage this trade.

There are 3 scenarios that come into play. The stock can go up, go down or stay flat over time.

If the stock moves up, we can close out the trade and bank the profit right away.

We can also hold and make additional profit if the stock continues to move up. Now once we have a large gain, I like to lock in the profits by selling a Call option. This locks in the profits while allowing the stock to continue to run. It also provides another avenue to make profits while reducing risk. We will cover this in another video.

If the stock moves down, we have time to wait until the stock comes back since we picked a long dated option.

We do that since we have a year and don’t know exactly the timing of when the stock will move. We don’t have to be concerned about losing any more money. If the stock moves down since the max loss is the $785 we paid up front. As long as our reason for buying hasn’t changed we wait it out. If something bad happens we can always sell to get out and collect what is left in premium.

If the stock stays flat, we hold. We wait following the same management approach as when the stock moves down since we have not collected profit yet.

Alright guys, that covers how we use our favorite high value option strategy and why now is the perfect time to use it to place a trade in (JWN) Nordstrom.

We will also showed you exactly how to put on the specific trade in Nordstrom (JWN) on the tastytrade platform. As well as how to manage and exit the trade.

Now I need your help! Please let me know your thoughts on this strategy. Where do you think Nordstrom is going? How you are investing in it or why you aren’t you? Do you think it is risky and if so why do you think so? Also, if you have any questions please let me know. I love to hear your comments and questions!